A perpetuity a special form of annuity pays cash flows – In the realm of finance, a perpetuity, a special form of annuity, stands out as a financial instrument that generates an unending stream of cash flows. Unlike annuities, which have a finite duration, perpetuities offer a perpetual flow of payments, making them a distinct and intriguing concept in the financial landscape.

This article delves into the intricacies of perpetuities, exploring their types, valuation methods, applications, and their relationship with annuities. By unraveling the complexities of this financial tool, we aim to provide a comprehensive understanding of its unique characteristics and significance.

1. Introduction: A Perpetuity A Special Form Of Annuity Pays Cash Flows

A perpetuity is a special form of annuity that pays cash flows indefinitely. Unlike an annuity, which has a finite number of payments, a perpetuity continues to pay cash flows forever. This unique characteristic makes perpetuities useful for valuing long-term investments and financial instruments.

The cash flows in a perpetuity are typically equal and occur at regular intervals, such as annually or semi-annually. The present value of a perpetuity is the sum of the present values of all future cash flows, discounted at a given interest rate.

2. Types of Perpetuities

Fixed Perpetuities, A perpetuity a special form of annuity pays cash flows

Fixed perpetuities pay a constant cash flow each period. They are the most common type of perpetuity and are often used to represent long-term investments with a fixed return.

Growing Perpetuities

Growing perpetuities pay a cash flow that increases at a constant rate each period. They are used to represent investments with a growing income stream, such as a stock that pays increasing dividends.

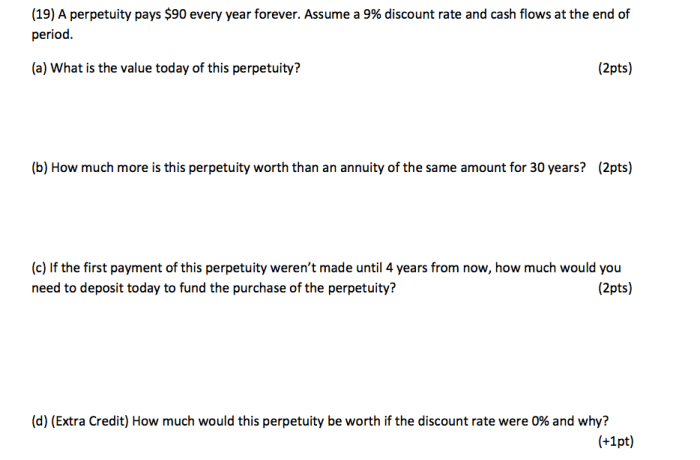

Deferred Perpetuities

Deferred perpetuities pay no cash flows for a specified number of periods before beginning to pay a constant cash flow. They are used to represent investments with a delayed return, such as a bond that pays no interest until maturity.

3. Valuation of Perpetuities

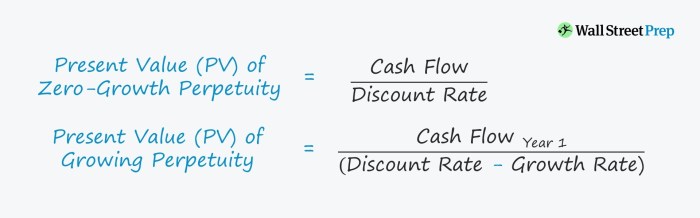

The present value of a perpetuity is calculated using the following formula:

PV = CF / r

Where:

- PV is the present value of the perpetuity

- CF is the annual cash flow

- r is the discount rate

The discount rate used to value a perpetuity is typically the prevailing interest rate for investments with a similar risk profile.

4. Applications of Perpetuities

Perpetuities are used in a variety of financial applications, including:

- Valuing long-term investments, such as stocks and bonds

- Determining the fair value of financial instruments, such as annuities and insurance policies

- Calculating the cost of capital for a business

- Estimating the present value of future earnings or expenses

Perpetuities can also be used to model the growth of populations, the spread of diseases, and other phenomena that exhibit exponential growth.

5. Comparison of Perpetuities and Annuities

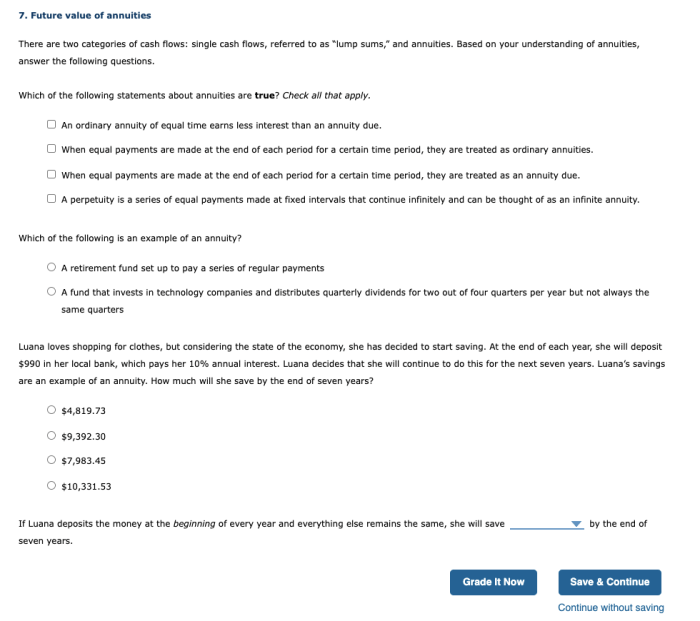

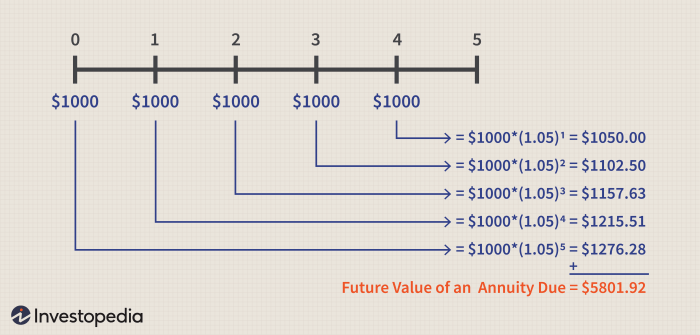

Perpetuities and annuities are both financial instruments that pay a series of cash flows. However, there are some key differences between the two:

- Perpetuities pay cash flows indefinitely, while annuities have a finite number of payments.

- The present value of a perpetuity is typically higher than the present value of an annuity with the same cash flows and discount rate.

- Perpetuities are often used to represent long-term investments with a fixed return, while annuities are more commonly used to represent short-term investments with a guaranteed return.

Query Resolution

What is the key difference between a perpetuity and an annuity?

A perpetuity is a special form of annuity that pays cash flows indefinitely, while an annuity has a finite duration and pays cash flows for a predetermined period.

How are perpetuities valued?

Perpetuities are valued using the present value formula, which considers the cash flows, interest rate, and duration of the payments.

What are the advantages of investing in perpetuities?

Perpetuities offer a steady and predictable stream of income, making them attractive for long-term investment strategies and retirement planning.